Steven Harper wrote a terrific piece on law firm culture in response to the latest Citi Private Bank/Hildebrandt update on the legal market. Harper is incredulous of Citi/Hildebrandt’s warning that “Law firms discount or ignore firm culture at their peril.” He makes the point that “consultants have encouraged managing partners to focus myopically on business school-type metrics that maximize short-term profits…what has resulted from that focus: the unpleasant culture of most big firms.”

The reverse does not have to be (in fact often is not) true. Namely, firms with a strong, collegial culture are not inherently doomed to poor economic performance. They may not top $3mm a year in profits per equity partner, but everyone working in those firms earns a very good living, they have strong and enduring client relationships, and they enjoy a balanced and rewarding professional life. Having that kind of positive firm culture requires work and discipline – and, especially, a commitment not to throw away long held values in the face of short term economic challenges.

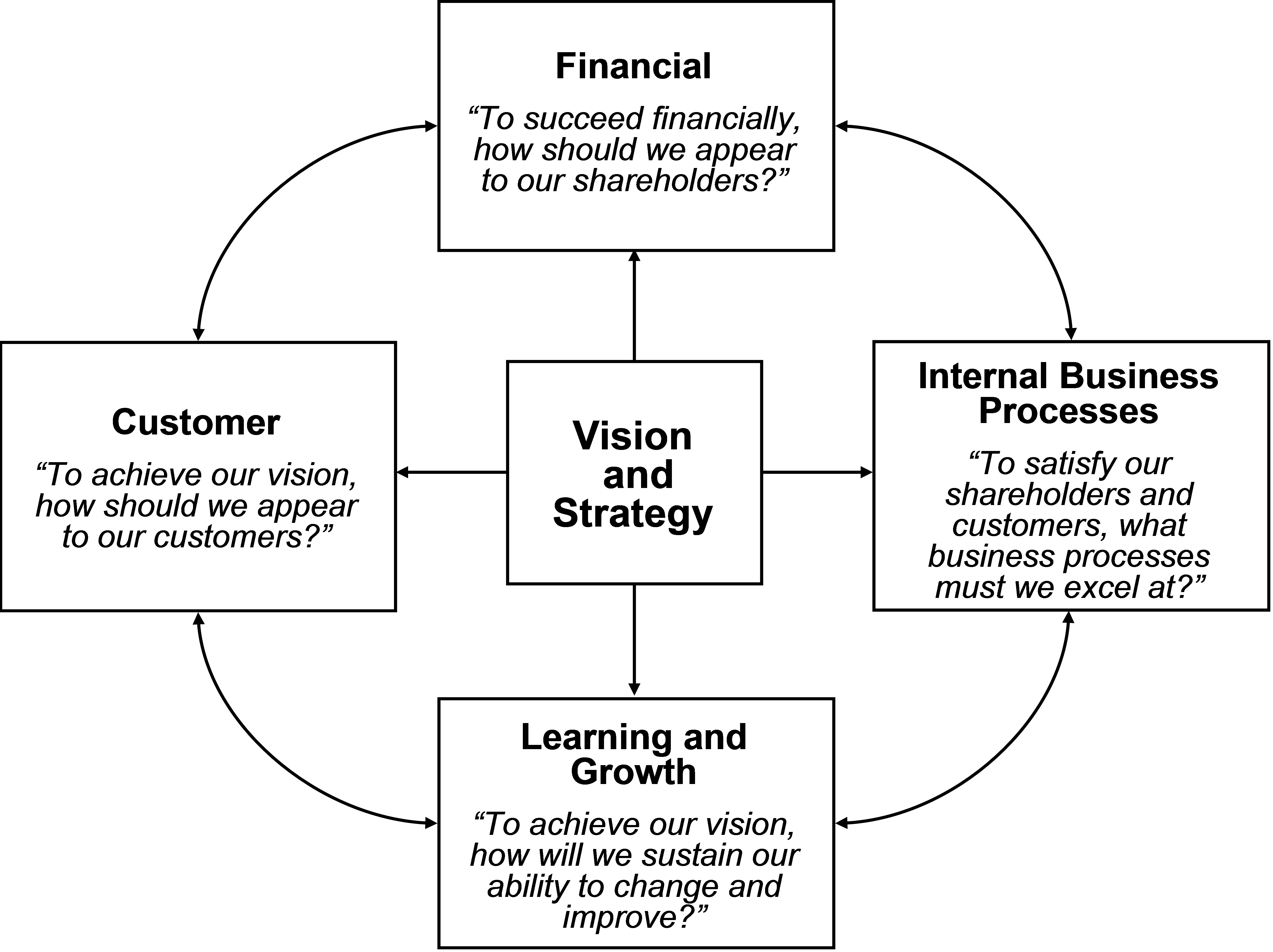

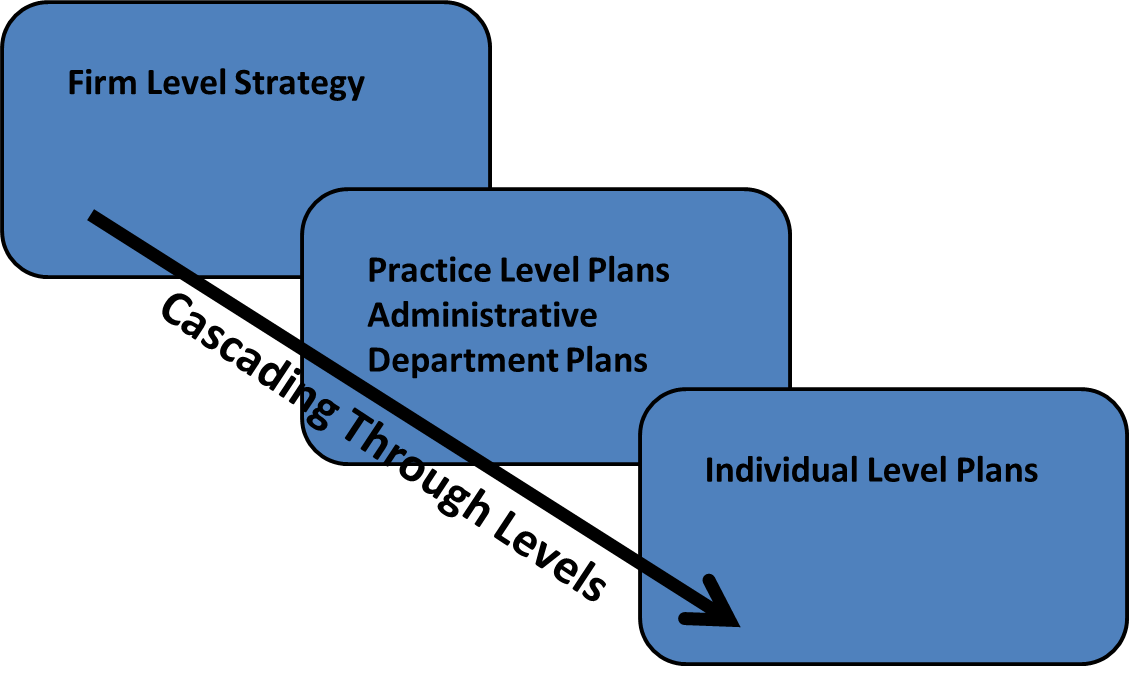

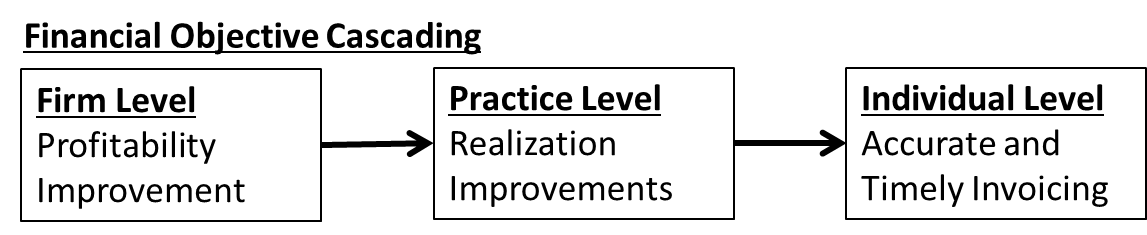

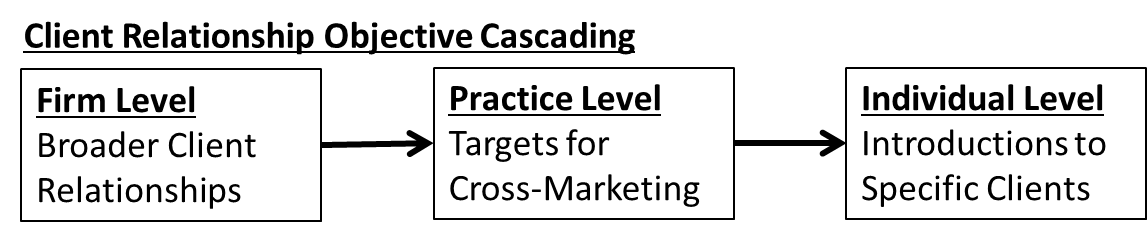

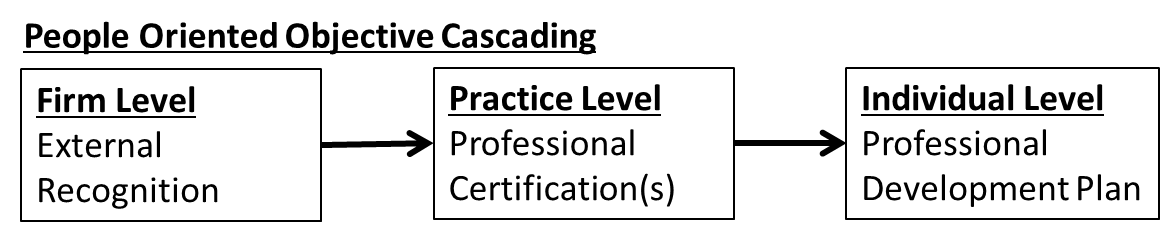

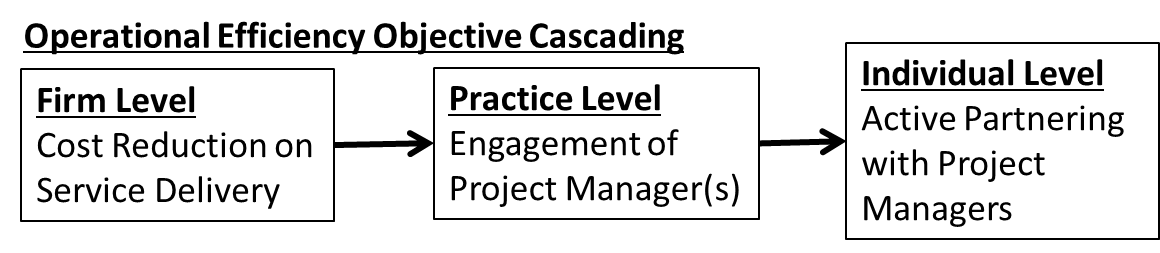

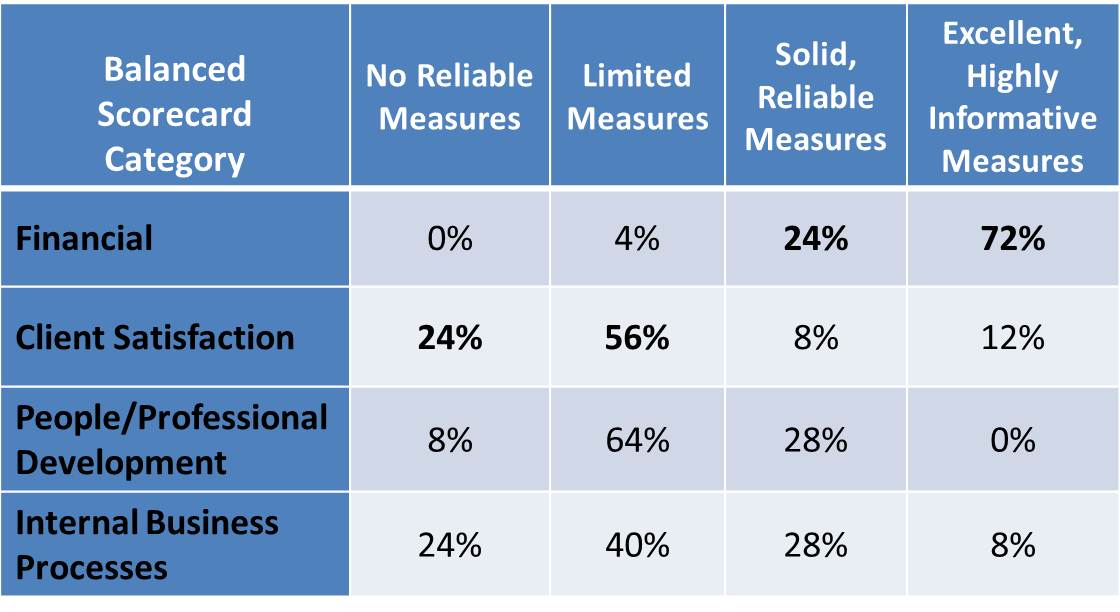

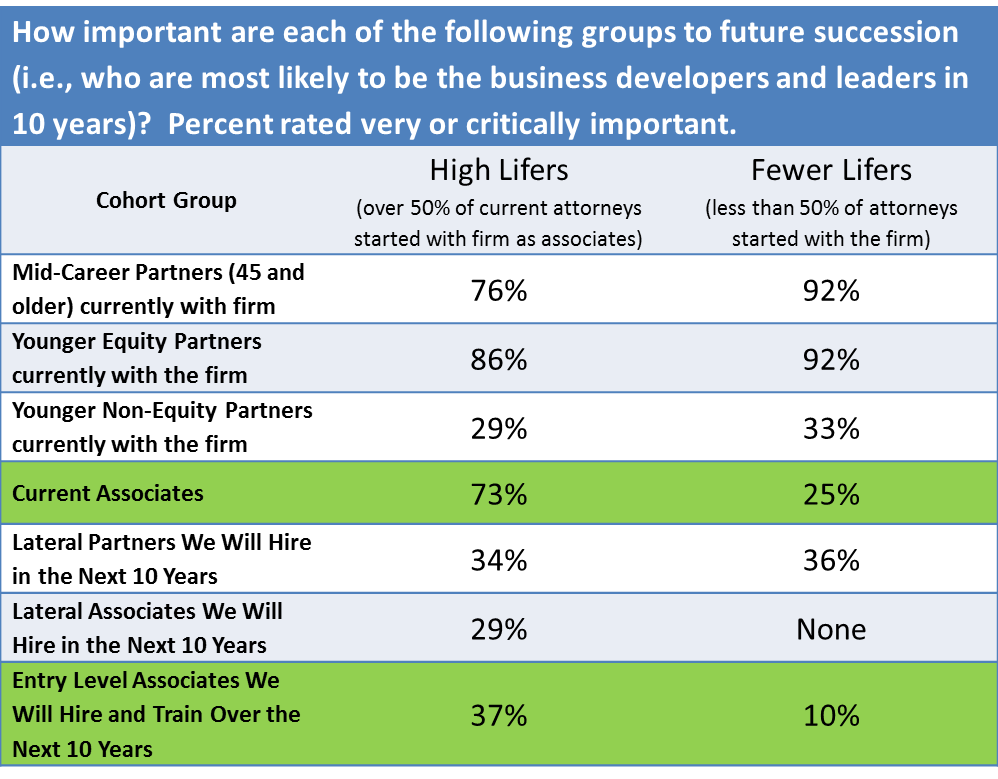

Our recent survey on best practices in law firm strategic planning confirmed this point. Namely, the firms experiencing the most successful results from strategic planning are much more likely to have articulated shared values or principles as part of that process. At the same time, those highly successful firms are much more likely to adopt and track measurable objectives as part of the strategy process. In other words, the most successful firms balance a strong commitment to long held cultural values with a pragmatic approach to setting objectives (i.e., financial, client relationship, and other measures).

Having had the pleasure and privilege of working with a number of firms over the years that have cultivated and sustained great cultures, here are five suggestions for how you can cultivate, embrace and sustain a set of shared values that define a great law firm culture.

- Honor the Founder(s) – When I started my consulting career at Arthur Young (that dates me), John Smock made sure everyone in the practice got a copy of a relatively short book entitled, Arthur Young and the Firm He Founded. That little book encapsulated many of the core values of the firm – and traced them to the values of the hard working Scotsman who immigrated to America and started the firm. Whether your firm was founded 20 or 200 years ago, you are likely to find some of the roots your firm’s values and culture in the character of your founder(s). Honor those roots.

- Celebrate a Milestone Year – Round number anniversaries lend themselves to celebrations (10th, 50th, 100th). So do record years, though they tend to arrive with more frequency and less fanfare. Take the opportunity of a milestone year to reemphasize the shared values that brought the firm to that point. Embrace and celebrate your culture and your shared values – not just the anniversary or the record.

- Document Your Stories, Your History and Your Culture – I have a number of books in my collection from clients – both law firm and corporate – in which the history of their organization (and its culture and values) is documented and described for posterity. Sometimes those books are commissioned in conjunction with an anniversary, others mark the passing of great leaders, and still others were done simply to capture the stories before they were lost to memory. Those stories may be the very best window into truly understanding the firm’s culture and the values – they are a way to connect our rational understanding of the values to our emotional understanding of values (see this brief slideshow for more). Stories can even be used when you need to drive cultural change (see Peter Bregman’s HBR article on the topic).

- Ask Your People to Define the Culture – We have used a technique very successfully over the years to isolate core values and help organizations coalesce around them. Ask a very simple question, “What three words best describe the values that endure over time in our firm?” The resulting word-cloud is enlightening and it helps to define (or reinforce) the firm’s shared values. It can be used in many settings to spark a discussion of shared values and the culture – keeping that culture front and center as other decisions are being made (e.g., employee reviews, partner compensation, lateral hiring, strategic planning, etc.).

- Put It In Your Plan – Finally, take a lesson from the firms having the most success with strategic planning and strategy implementation. Articulate your values as part of your overall strategy. Include a long term mission as part of your strategic plan and include a concise articulation of your core values in that mission.

While the embrace of firm culture and values may be belated for some, it is welcome nonetheless. Whether your firm is large, mid-sized or small, sustaining a positive firm culture is a critically important element in a genuinely successful law firm strategy. Who knows, it might even land your firm at the top of the Vault.com rankings for best firms to work for.