Our April 2012 strategy question of the month focuses on strategic growth. The latest Am Law 100 found that headcount growth has resumed across the largest firms in the U.S. Further, those tracking law firm mergers found that activity in 2011 (i.e., competed mergers) had returned to pre-recessionary levels.

We wanted to get a sense for how integral mergers and acquisitions are to law firms’ growth strategies. So, we asked a very direct question, “Does your firm plan (hope) to complete at least one merger and/or acquisition by the close of 2013 that would grow headcount more than five percent from a single combination?” Those answering ‘yes’ were asked to rate the relative importance of a range of factors they consider when evaluating potential merger candidates. Those answering ‘no’ were asked to share the considerations that led their firm to opt out of merger and acquisition activities.

MERGERS AND ACQUISITIONS AS A GROWTH STRATEGY

The survey split almost 50/50 relative to whether firms plan (hope) to complete a combination that will add more than five percent to their headcount. Slightly less than 50% said that strategic combinations (of at least the scale noted here) are definitely part of their strategy. Meanwhile, just over half the respondents noted that they do not expect to complete a combination of reasonable scale over the next 18 months.

FACTORS DRIVING THE EVALUATION OF STRATEGIC COMBINATIONS

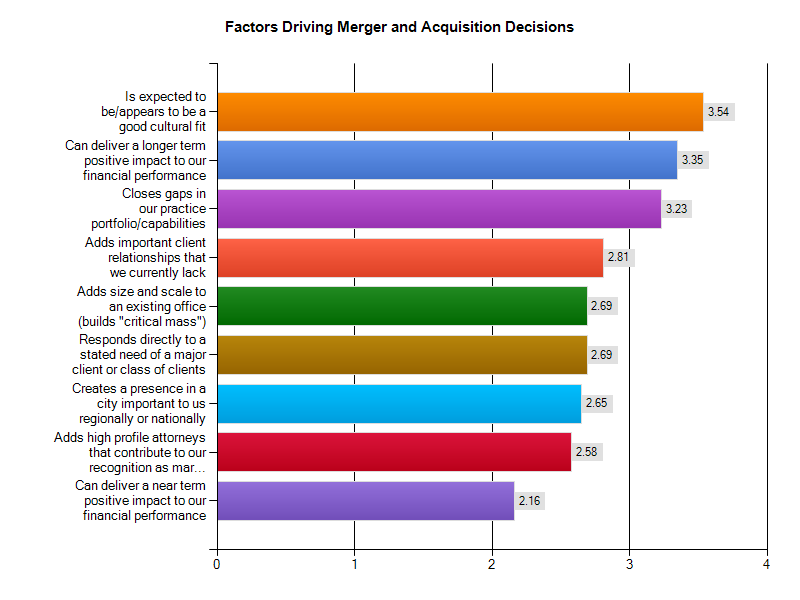

Factors driving the evaluation of prospective merger and acquisition candidates break-down into a few categories. First, there are a couple of factors that appear to be foundation – that is, factors that are not so much a driver for seeking merger partners, but that a lack thereof will squelch discussions with prospective merger candidates. Second, are factors that are clearly strategic to an overwhelming majority of the firms actively evaluating merger candidates. Third, are factors that are strategic for many, but not for a significant minority of firms seeking a strategic combination.

Foundational Factors

Cultural fit appears to be an unquestioned foundational factor – over 96% considering it to be an important or critically important factor (and over 60% rating it critically important). Similarly, the ability of a combination to deliver long term financial improvement appears to be a foundational factor – again, over 96% consider long term financial contributions to be important on some level (though only 46% rate it critically important).

Practice Portfolio Considerations – Most Strategically Important Factor

Over 90% of the firms actively seeking strategic combinations are looking (at least in part) for a merger partner that can close gaps in their own firm’s practice portfolio or capabilities (i.e., rate it important or critically important). In fact, as an evaluation factor for prospective merger partners, it rates nearly as highly as the foundational factors. We have written extensively on strategies related to managing practice portfolios – most recently in our book for the Managing Partner magazine bookstore. We will likely provide an abridged discussion here on the blog in early May 2012.

Geographic Considerations – a Mixed Bag

Adding size and scale to existing offices is an important strategic consideration – a geographic factor that figures into the strategy of roughly three-quarters of responding law firms. By contrast, adding a presence in a new city is important to many firms seeking a strategic combination, but not on the level of ensuring “critical mass” in existing offices.

Client Considerations – Clearly Important, But Not Universal

A very strong majority (over three-quarters) of firms do expect a strategic combination to add important client relationships that their firm currently lacks. Likewise, a large majority of firms noted that their evaluation of prospective merger candidates in part “responds directly to the stated needs of existing clients.” Stated client needs are not as universal a driver as closing portfolio gaps – or even as adding important new relationships – yet, it is clearly an important consideration.

High Profile People – Important, But Not Critical

Firms clearly want a strategic combination to add high profile people to their firm. However, it is not a critically important factor (only eight percent of firms consider the addition of high profile people to be “critically important”).

Growing Maturity

Finally, we were pleased to see an indication of growing maturity among those looking for strategic combinations. Specifically, a large majority of firms are not looking for a near term positive financial impact from mergers and acquisitions – over two-thirds of respondents consider near term finances to be either not a factor or only a minor factor. Had that question been asked 10 years ago, the responses may have been quite different.

OPTING OUT OF STRATEGIC COMBINATIONS

Most of those responding that they were not planning (or hoping) to make a substantial strategic combination of the next 18 months were kind enough to share their reasoning and rationale for opting out of merger activity. We have grouped those open-ended responses into the following points.

- Nearly half of those not actively seeking a strategic combination noted that they are actively growing via smaller scale initiatives such as lateral hiring, smaller acquisitions (that would not meet the “five percent headcount growth” cut-off in the initial question), or via “strategic organic growth.”

- Many noted – often in thoughtful and thought-provoking terms – that growth via mergers and acquisitions runs counter to their well-considered strategies (e.g., commitment to a “boutique” strategy, a “focused model,” or a solid existing market position).

- Several respondents (roughly a quarter of those not actively pursuing a strategic combination) said that they remain open to discussing combinations when approached, but are not actively seeking a merger partner.

- A couple of respondents recently completed major mergers and do not anticipate doing another significant combination over the next 18 months.

- A couple of respondents noted that they are currently reevaluating their overall strategy and have not determined yet if they are in the hunt for a combination.

- Finally, one respondent noted that they have looked in the past and do not believe there is an appropriate merger partner for their firm.

* * * *

As always, we thank the many firms that responded to this month’s strategy question. The response rates continue to grow, the insights are very helpful to us as strategy consultants, and we hope they are useful to you as leaders of your respective organizations.

The comments section is open and we welcome dialog – online here or off-line via phone and email.